What is Restaking?

Restaking means reusing staked ETH again to provide economic security for other protocols. Middlewares like oracles, bridges, DA providers, and sidechains must build the trust layer independently. Emerging protocols' token prices are highly volatile and usually can't gather enough capital or validators to provide high-level security. Eigenlayer, the cornerstone of restaking, aims to solve this issue by reusing the economic security of ETH in native and liquid modes.

What are the rewards associated with Restaking?

Participating in restaking can bring users restaking yield and potential airdrops apart from ETH staking profit.

Restaking rewards building upon staking rewards

According to Ethereum.org, by April 17, 2024, native ETH staking APR is about 3.7%. Among LRTs, stETH APR is about 3.5%, and rETH APR is about 3.35%. Thus, the average value of 3.475% is the staking APR.

Restaking rewards derived from AVS (Actively Validated Services) is currently unknown without reward distribution schemes.

$EIGEN Airdrop

Many early investors have indicated that the token will be released in 2024 Q2 or Q3. With Eigenlayer and EigenDA mainnet successfully launched this week, we expect $EIGEN to be launched in the foreseeable future.Bankless believes EigenLayer's ecosystem position is similar to Celestia's, valuing it at around $10 billion to $20 billion FDV at its initial launch. Assuming the airdrop percentage is 10%, there will be $1 billion to $2 billion EIGEN airdropped as the first rounds of potential restaking rewards.

With the successful deployment of Eigenlayer and EigenDA mainnet, investors are eagerly awaiting the arrival of $EIGEN as the next milestone in the project's roadmap. The estimated valuation of each point, ranging from $0.08 to $1.21, reflects the optimism and potential market demand surrounding the token. This valuation range takes into account various factors, such as the project's technological advancements, the leading role in restaking, market conditions, and investor sentiment.

LRT Protocols Airdrop

Every LRT protocol has the concept of loyalty points, which can be earned by depositing and locking LST or $ETH. Recently, 85,659 addresses claimed 47M native tokens $ETHFI via airdrop. But the airdrops are not finished. As more batches of $ETHFI are left, restakers can still be rewarded for holding eETH after the first airdrop.

AVS Airdrop

AVS refers to any system that requires a decentralized validator network and relies on EigenLayer to "rent" security from Ethereum. Many AVS projects may airdrop for EigenLayer restakers, as $ALT did when it launched its token a few months ago. Some early AVS projects building on EigenLayer include EigenDA (Data Availability), Omni Network (Rollup Interoperability), Espresso Systems (Decentralized Sequencers), Altlayer (Restaked Rollup), etc. According to the Ether.fi team, 8 AVSs will soon start distributing points or token rewards to EtherFi's LRT eETH holders.

How to participate in Restaking?

There are three ways to restake: native restaking on EigenLayer, LST restaking on EigenLayer, and liquid restaking protocols.

Native Restaking

Users can deposit their $ETH into EigenLayer, which will then be locked. In other words, to complete native restaking, users need to set their Ethereum validator's withdrawal credentials as their EigenLayer's smart contracts—EigenPod. An EigenPod is a smart contract managed by users designed to facilitate the EigenLayer protocol in monitoring and managing balance and withdrawal statuses. Users can create their EigenPod. An Ethereum address can only deploy a single EigenPod. The address that deploys an EigenPod becomes the owner of the contract and gains permission for restaking and withdrawal operations. Then, a user can use any number of validators' withdrawal credentials as the EigenPod address; note that the number of Ethers restaked cannot be less than 32.Currently, there is no time or amount limit for ETH restaking in EigenLayer. However, there is a specific time window for LST restaking (it reopened on April 16th, 2024).

Liquid Restaking

Apart from restaking $ETH, users can restake liquid staking tokens (LSTs) into EigenLayer. EigenLayer enables several LSTs, as shown in the following chart.

Yet the restaked tokens are not liquid and thus not capital efficient. Liquid restaking protocols allow users to restake $ETH or LSTs while maintaining liquidity through a token (“LRT”). These LRTs can then be used across the DeFi space to generate incremental yield.

The LRT Landscape

As of April 01, 2024, LRT protocols have gained significant adoption with over $6.77 billion in TVL as per DeFiLlama. Ether.fi, Puffer Finance, Kelp DAO, and Renzo Protocol have emerged at the top of the rankings for now, while many other teams are also innovating rapidly and seeking to enter the market in the foreseeable future.

Below are a few examples of the LRT protocols:

Puffer Finance

Puffer is a decentralized native liquid restaking protocol (nLRP) built on Eigenlayer. It introduces native Liquid Restaking Tokens (nLRTs) that accrue PoS and restaking rewards. Nodes within the protocol leverage Puffer’s anti-slashing technology to enjoy reduced risk and increased capital efficiency, while supercharging their rewards through native restaking exposure.

By April 16th, 2024, over 381K ETH had been staked in the Puffer. Puffer is a highly technical LRT protocol. It uses the Secure-Signer signature approach funded by the Ethereum Foundation to physically isolate key access directly. The key is only accessed when the node runs and remains encrypted at rest. It is worth noting that Secure-Signer is complimentary with DVT, which decreases the risk of single-point failure.

To tackle two traditional problems which are Rug-pooling and Lazy NoOps, Puffer introduces Validator Tickets (VTs). When registering a validator, NoOps lock 1 ETH worth of pufETH as a bond and deposits a minimum of 28 VTs. In exchange, they are allocated 32 ETH to run a validator, and are entitled to 100% of the Proof of Stake (PoS) rewards they produce over as many days as VTs they've deposited. In other words, NoOps pay pufETH holders ETH upfront to run a validator. VTs create new trading opportunities, address “rug-pooling”, and incentivize good performance. pufETH holders earn rewards immediately when VTs are purchased. Consuming VTs allows the node operator to keep 100% of the validator’s earnings.

Additionally, Puffer has plans to develop its Layer 2 solution based on EigenDA and aims to distribute transaction fees to pufETH holders.

pufETH is a reward-bearing ERC20 token, following in the footsteps of Compound's cToken design for optimal DeFi compatibility. It represents a novel approach in the liquid staking domain, introducing several features that enhance stakers' rewards and interaction with DeFi protocols.

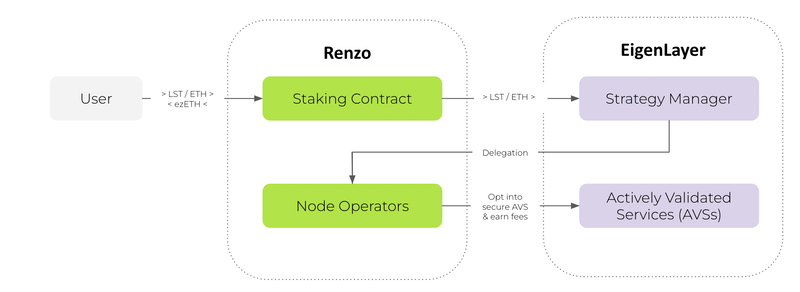

Renzo

Renzo is a Liquid Restaking Token (LRT) and Strategy Manager for EigenLayer. It is the interface to the EigenLayer ecosystem, securing Actively Validated Services (AVSs) and offering a higher yield than ETH staking.

Renzo is built to be primary on-ramp / off-ramp for Ethereum restaking, using a combination of smart contracts and operator nodes to secure the best risk / reward restaking strategy.

There are over 945k ETH staked in Renzo by April 16th, 2024. Renzo is actively working with the cross-chain protocol Connext, which currently allows users to restake ETH on Arbitrum, Base, BSC, Blast, and other chains in addition to the Ethereum mainnet.

ezETH is the liquid restaking token representing a user’s restaked position at Renzo. Users can deposit native ETH or LSTs and receive ezETH. ezETH is a reward-bearing token, the restaking position will reflected in the price of ezETH.

Rio Network

Rio Network is a network for issuing Liquid Restaking Tokens (LRTs), with a mission to provide the best access to risk-managed ETH total return without sacrificing liquidity. Rio will help scale the restaking ecosystem and reduce the cost of capital for Actively Validated Services (AVS) by providing the best risk-managed access to restaking rewards. It has 5 main functions: Pooling user assets and issuing LRTs; Delegate assets to professional operators; Restore capital on EigenLayer; Collect and distribute rewards; and Safeguard the network via governance.Rio's first LRT is Restaked Ether (reETH), representing ETH natively restaked by Rio's professional operator set to secure a risk-adjusted AVS set. The Rio Network is composed of one or more Rio Liquid Restaking Tokens (LRT). The RioDAO proposes the creation and configuration of new LRTs via the LRT Issuer contract, which spawns contracts that build out an instance of an LRT on the Rio Network. These LRTs coordinate funds management within the EigenLayer network, AVSs, and its dependencies. Regarding node operators, HashKey Cloud is selected as one of Rio Network's first operator sets. It is intended to run ETH validators and maintain infrastructure for select Actively Validated Services (AVS).

HashKey Cloud’s partnering with LRT Protocols

From the early stages of the LRT protocol's testnet phase, HashKey Cloud has been actively involved, leveraging our extensive expertise and collaborating closely with LRT protocols. HashKey Cloud is one of the first node operators to run ETH validators and the AVS validation services for LRT protocols, including Puffer Finance, Renzo, Rio NetWork, and Swell. We enabled secure and stable node validation service for our partners and the end users. While providing restaking node operator service, we tailored selective AVS strategy to secure the best risk/reward restaking strategy.